Financial Support for the Success of our Schools

by Cheryl Nardino, Business Administrator

The primary responsibility of the Business Office is the management of all finances for our school district. These include the performance of purchasing, payroll, accounts payable, financial planning, and budgeting. These areas are the responsibility of the Business Administrator along with lease purchasing and bond financing. The Business administrator also oversees the annual audit, health & other staff benefits programs, transportation, and the cafeteria program.

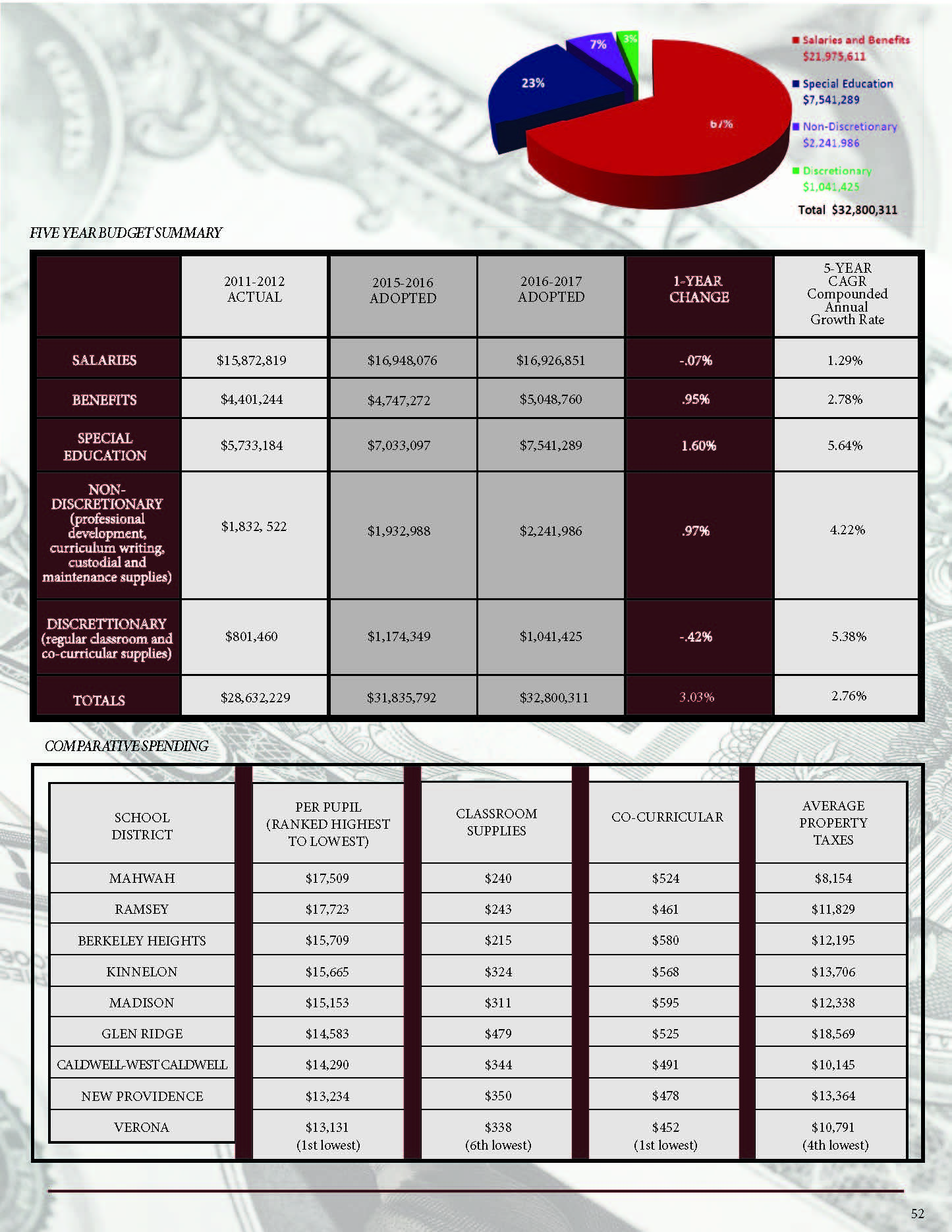

The greatest challenge the district faces in terms of our budget is the continuation of the 2% NJ cap on tax levy. Although there is a 2% cap, banked cap and the election of budget waivers allows the district to create a budget that is above the cap. From budget years 2012-2013 to 2016-2017, the tax levy increases have ranged from 2.37% to 3.08.

The budget timeline and budget process begins in November when the administrative team identifies the needs of every school and each department budget. In December, the Business Administrator and Superintendent review the needs assessment in preparation of the budget to the Board of Education. Beginning in January, the budget is reviewed and discussed in each respective Board sub-committee. The preliminary budget is adopted at the end of March each year. The annual budget presentation and adoption of the final budget occurs at the end of April. The budget is effective beginning July 1 of each year through June 30 the following year.

When the Board presents the budget, the expenditures are summarized in four major categories:

- Salaries and benefits comprise 67% of the budget

- All special education expenditures including the respective salaries in the program, encompass 23% of the budget

- Non-discretionary expenditures, which are those necessary in operation of the district (i.e. professional development, curriculum writing, custodial/maintenance supplies), include 7% of the budget

- Discretionary spending is 3% of the budget and are those items that can be deferred to subsequent years, but are ultimately required to support programs and co-curricular activities.

In terms of revenues, Verona property taxes fund 94.41% of the budget, followed by state aid that amounts to 2.79% of the overall revenue stream. The balance of the revenues is made up of extraordinary aid, tax relief from prior year excess surplus, student tuition, rental income, and miscellaneous revenue.

Despite these challenges, the Verona Public Schools takes great pride in our collective success and achievements of not only our students, but our dedicated and exceptional staff. On a comparative basis, the NJ Department of Education lists Verona as 15th lowest spending in our peer group of 69 like school districts.

Click here to read more articles in the Verona Public Schools Magazine 2016-2017 Edition.